Where should you go after military retirement? It’s one of the most personal and practical questions a Veteran can ask. Whether you’re preparing for retirement after 20+ years of service or you’ve already transitioned into civilian life, choosing the right state to call home can significantly impact your finances, health, and quality of life.

To help answer that question, we analyzed a wide range of data to create a custom scoring model tailored specifically for military retirees. This data-driven study examines what truly matters to post-service Veterans: housing costs, access to healthcare, employment opportunities, state-level tax policies on military pensions, and overall quality of life. The goal? Help you identify the best states to live in after retiring from the military, not based on opinion, but on real numbers that affect your day-to-day life.

This ranking considers military-friendly tax exemptions, access to VA facilities, Veteran hiring protections, unemployment rates, and other factors. It also includes one of the most unique elements in any retiree ranking, our proprietary Veteran Hiring Preference Score, which evaluates how well each state supports Veterans in the public sector job market.

Best States for Military Retirees

1. South Dakota

As a state, South Dakota doesn’t just reward Veterans for their service; it makes long-term stability feel achievable. Military retirement pay is fully exempt from income tax, and disabled Veterans benefit from property tax relief. With mortgage-free homeownership costs averaging just $279 per month, the financial picture here is remarkably strong.

What sets South Dakota apart from similarly affordable states is how it pairs cost savings with real opportunity. The Veteran unemployment rate is just 1.5%, the lowest among all top-ranked states. Public hiring policies are also Veteran-friendly, with a Hiring Preference Score of 6. Finding work here after the military isn’t a daunting task.

While it may not have the year-round sunshine of southern states or large metropolitan centers, South Dakota offers Veterans something even more valuable: predictability. The straightforward systems, accessible benefits, and low cost of living mean your retirement income works harder for you from the very start. Find more details about benefits in the Mount Rushmore State from the South Dakota Department of Veterans Affairs website.

2. Montana

Montana offers a compelling combination of simplicity and support that stands out among Western states. Military retirement income receives a partial tax exemption, and disabled Veterans are eligible for full property tax relief. Housing costs are impressively low, with mortgage-free households averaging just $261 per month, making it one of the most affordable homeownership markets in the nation.

This isn’t just a state for retirees looking to slow down. Many Veterans choose Montana for its balance of financial security and access to work. With a Hiring Preference Score of 4 and a Veteran unemployment rate of 2.7%, Montana supports those who want to re-enter the workforce without big-city competition. Strong state education benefits also offer opportunities for reskilling or continued education.

Montana appeals to Veterans who want independence without isolation. Although it may lack the infrastructure of more populous states, its policies are no less robust. Here, a quiet life doesn’t come at the expense of tangible benefits. Explore the full range of Veteran services available in Big Sky Country by visiting the Montana Department of Military Affairs.

3. Alaska

Alaska’s draw has always been its sense of freedom, and for Veterans, that freedom comes with significant financial perks. The state imposes no income tax, fully preserving military retirement pay. Disabled Veterans also receive partial relief on property taxes. While housing costs are somewhat higher here, averaging $393 per month for mortgage-free owners, the absence of state taxes often makes up the difference.

Alaska’s unique job market gives it a 7 on the Hiring Preference scale, indicating a strong public hiring culture for Veterans. The state’s Veteran unemployment rate is 4.4%, slightly higher than that of the other top 10 states, but well within a manageable range given the available support systems. Public employment and access to education are both within reach.

Veterans who move to Alaska often look beyond benefits for space, purpose, and a sense of life after service that doesn’t feel confined. Alaska offers that while respecting your service through policy, not just platitudes. You can learn more about the benefits available in the Last Frontier on the Alaska Department of Military and Veterans Affairs website.

4. Wisconsin

Wisconsin is a place where Veterans can put down roots. Military retirement income is fully exempt from state income tax, and qualifying disabled Veterans receive a full exemption on property taxes. Mortgage-free homeowners pay just $333 per month on average, which is especially helpful for Veterans living on a fixed income.

The state is also well-positioned for those who want to continue working. Wisconsin earns a Hiring Preference Score of 6 and reports a Veteran unemployment rate of just 2.4%. Combined with strong state education benefits, this creates a stable, supportive environment for post-service career development.

Wisconsin’s sense of balance makes it stand out. The benefits are generous and easily accessible, the job market is healthy without being cutthroat, and the communities are large enough to offer amenities but small enough to feel personal. It’s not flashy, but it works. Discover the Veteran benefits available in the Badger State by exploring the Wisconsin Department of Veterans Affairs site.

5. New York

New York offers one of the most comprehensive benefit landscapes for military retirees, albeit at a slightly higher cost. The state fully exempts military retirement income from taxation and provides partial property tax relief for disabled Veterans. Mortgage-free housing costs are higher than average at $457 per month, but that number tells only part of the story.

The state invests heavily in public-sector hiring, earning a Hiring Preference Score of 7. Veteran unemployment is at 4.0%, and with an expansive network of city and state agencies, Veterans have access to jobs across various sectors, including education, law enforcement, and healthcare. Add in excellent state-funded education benefits, and New York makes it possible to pivot into an entirely new phase of life.

Where some states offer simplicity, New York offers scale. From Buffalo to Long Island, Veterans have access to an infrastructure that’s difficult to match. For those who can afford a slightly higher cost of living, the return on investment is undeniable. To get a complete picture of what the Empire State offers its Veterans, check out the New York State Department of Veterans’ Services.

6. Connecticut

Connecticut may not scream affordability, but it punches above its weight in terms of Veteran benefits. Military retirement pay is fully exempt, and disabled Veterans receive full property tax relief. Monthly housing costs for mortgage-free owners average $473, the highest in the top 10, but meaningful tax breaks help offset this.

Veterans seeking a second career will find moderate support here. The state earns a Hiring Preference Score of 5 and reports a Veteran unemployment rate of 5.0%. While these numbers are less competitive than those of other states, the state offers strong educational benefits and a high level of access to public services.

The value in Connecticut comes from structure. For Veterans wanting to live in a state with clearly defined systems and well-funded policies, this state is worth considering. It may cost more, but the services are built to deliver. See how the Constitution State supports its Veterans by visiting the Connecticut Veterans Affairs site.

7. Florida

Florida has long been considered a haven for retirees, including Veterans. The state does not charge income tax, and military retirement pay is fully exempt. Disabled Veterans receive property tax relief, and monthly housing costs for mortgage-free homeowners are just $306.

Florida really distinguishes itself in workforce support. The state boasts a Hiring Preference Score of 8, one of the highest in the country, and a Veteran unemployment rate of just 2.6%. These clearly signal that Florida values continued service from its Veterans in education, law enforcement, and civil roles.

With its large Veteran population, established benefits infrastructure, and consistent job access, Florida remains a top-tier destination. The temperate weather doesn’t hurt, but its policy consistency really makes the case. Find out more about what the Sunshine State offers on the Florida Department of Veterans Affairs website.

8. Massachusetts

Massachusetts delivers for Veterans beyond the basics. Retirement income is fully exempt from state taxes, and disabled Veterans are eligible for partial property tax relief. Housing costs are higher than average, with mortgage-free owners paying around $406 per month, but the benefits of architecture are robust.

This state invests in its people. Massachusetts scores a 6 on Hiring Preference and reports one of the lowest Veteran unemployment rates in the top 10 at 1.8%. The state also leads in education benefits, providing Veterans and their families with a real pathway to higher education and technical training.

For those who can afford the higher costs, Massachusetts provides unmatched institutional access. Whether you want to enroll in a degree program, enter a second career, or live in a state that prioritizes public service, it’s an excellent choice. Veterans in the Bay State can explore available services and support at the Massachusetts Executive Office of Veterans Services.

9. Texas

Texas offers Veterans a powerful mix of tax relief and economic opportunity. Military retirement pay is fully exempt, and disabled Veterans benefit from generous property tax waivers. The state also remains highly affordable, with mortgage-free homeowners paying an average of just $296 per month.

Texas stands out for employment support. It reports a Veteran unemployment rate of only 1.6%, one of the lowest in the country, and holds a Hiring Preference Score of 5. That’s a strong environment for those wanting to stay active in the workforce or transition into the public sector.

Texas also benefits from scale. The state’s size and diversity mean Veterans can choose from rural quiet, urban energy, or suburban balance. It’s a choose-your-own-adventure state, with the benefits to back it up. Everything’s bigger in Texas, including its commitment to Veterans. Visit the Texas Veterans Commission to learn more about your benefits.

10. Arizona

Arizona has made major strides in recent years to become one of the most Veteran-friendly states in the country. Military retirement pay is now fully exempt, and the state provides partial property tax relief for disabled Veterans. Mortgage-free homeowners enjoy low housing costs, averaging $268 per month.

Arizona really stands out for its approach to employment. With a Hiring Preference Score of 9, the highest in the top 10, and a Veteran unemployment rate of just 1.8%, the state provides real access to post-military careers in government, education, and public safety.

Combine the affordability, policy clarity, and job access, and Arizona delivers one of the best all-around retirement packages for Veterans who want to keep moving forward. It’s not just a warm place to live — it’s a smart one too. From housing support to education programs, the Grand Canyon State has your six. Head to the Arizona Department of Veterans’ Services to see what’s available.

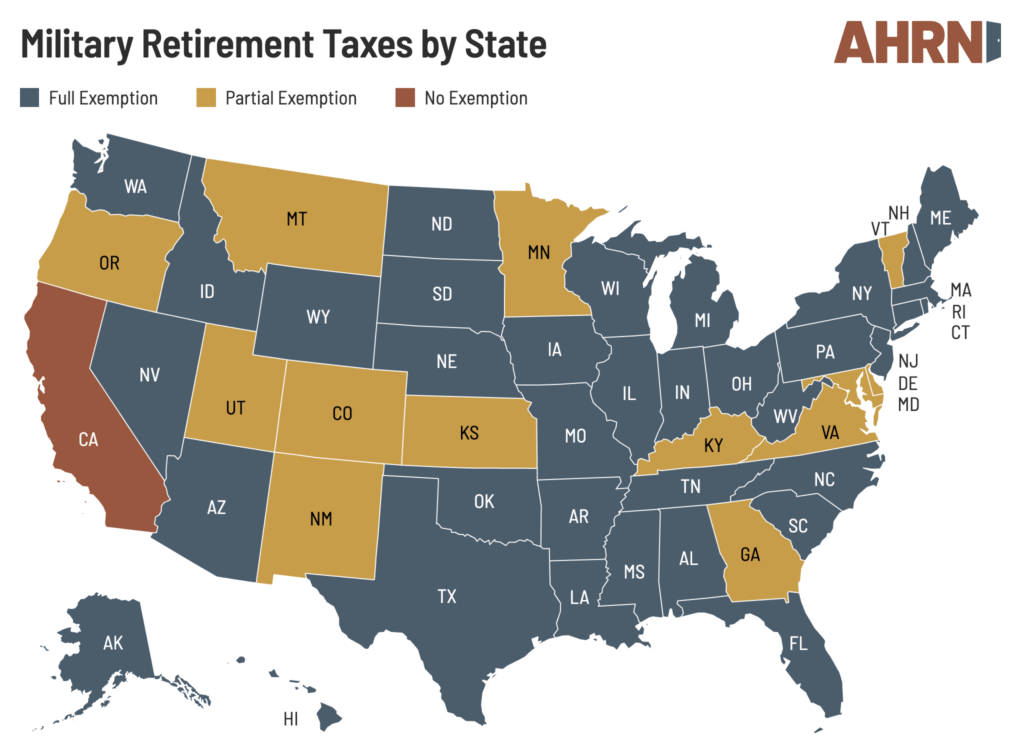

States With No Military Retirement Tax

Almost every state has some sort of exemption from taxes on your military retirement funds, except for California, which does not allow this tax exemption. The following 13 states only allow a partial exemption: Colorado, Delaware, Georgia, Kansas, Kentucky, Maryland, Minnesota, Montana, New Mexico, Oregon, Utah, Vermont, and Virginia. The other 36 states allow for full exemption of taxes on military retirement.

For retired service members living on a fixed income, these tax exemptions can make a substantial difference over time. Keeping more of your military pension each month means greater flexibility with housing, healthcare, and travel expenses. For many Veterans, it opens the door to homeownership or early retirement as well. All top 10 states on our list abide by this military tax exemption. Choosing one of these states with no or low taxes on retirement pay helps stretch your benefits further, especially in today’s economy, where every dollar counts.

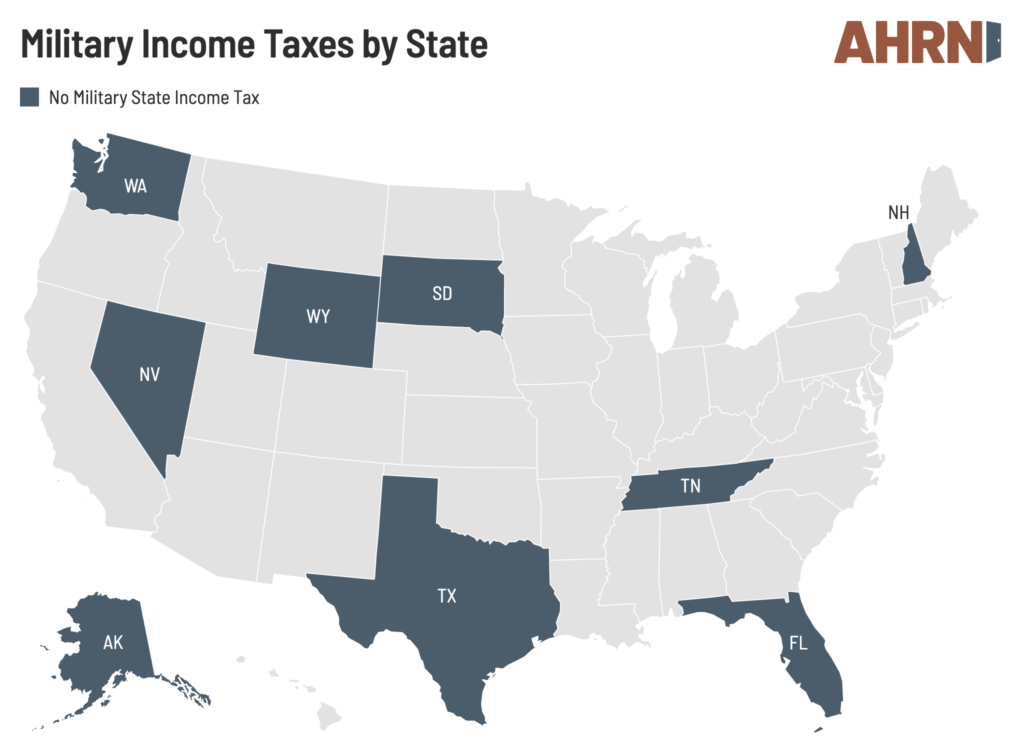

States That Don't Have Military State Income Taxes

Additionally, the following states don’t require military members to pay state income tax on military retirement pay because no state income tax is collected at all. Four of these states also ended up on our top 10 list:

-

Alaska

-

Florida

-

Nevada

-

New Hampshire (dividend and interest taxes only)

-

South Dakota

-

Tennessee

-

Texas

-

Washington

-

Wyoming

Tax codes vary from state to state, so check with a financial professional for the most up-to-date information about tax laws, income brackets, and other relevant details. They can help you narrow your options as you consider a new home and keep you updated on any tax changes that happen year to year.

Whether your ultimate military retirement plans include hitting the open road for adventures, hiking scenic trails with other Veterans, or relaxing on a sandy beach with family and friends, being able to keep more of your retirement income in the above states can help turn those dreams into reality.

Additional Considerations for Retired Military

Some considerations, such as climate and proximity to relatives, are subjective choices unique to each Veteran. However, plenty of tangible distinctions exist when deciding on the right state for you. These might include:

-

Is there an established Veteran community already in the state?

-

Is healthcare for Veterans, including disabled Veterans, easily accessible?

-

Are on-installation services available nearby?

-

What is the general cost of living in that area?

-

Does the state have a robust economic environment?

Researching these considerations while also taking into account your personal preferences will help you find the right state and city for you.

Where Should Military Veterans Retire in 2026?

Choosing where to retire from the military isn’t just about the view from your back porch: it’s about how far your retirement income can go, how easily you can access healthcare, and whether the state supports the next chapter of your life.

This report was built to provide retiring service members with a clear, objective comparison of how each state supports Veterans financially and professionally. Using publicly available data across multiple categories — including housing costs, military retirement tax policy, Veteran unemployment rates, and public-sector hiring protections — we created a scoring model designed to identify states where military benefits are more extensive and post-service quality of life is measurably stronger.

All 10 states at the top of our rankings offer full exemptions on military retirement income and show a consistent commitment to Veteran employment and support services. While personal factors, such as proximity to family or climate preferences, always shape where Veterans choose to retire, this study provides a starting point grounded in economic and policy realities.

We recommend that Veterans explore each state’s Department of Veterans Affairs website, review the most current benefit structures, and consider working with a financial advisor to understand how state-level policies align with individual retirement goals. As the national conversation around Veteran support continues to evolve, data like this helps bring clarity to one of the most important decisions a service member makes after leaving active duty.

Methodology

To create this ranking of the best states for military retirees, we compiled and analyzed publicly available data from federal sources, state tax codes, and Veteran-focused benefit programs. The final model was designed to highlight areas where military retirement income extends further, employment opportunities are strong, and Veteran support is integrated into state policy.

Data Sources

All data used in this study came from trusted public and government datasets, including:

-

U.S. Census Bureau for housing costs and state-level infrastructure

-

State government websites and tax code documentation for military retirement income exemptions and property tax relief

-

Bureau of Labor Statistics (BLS) for Veteran unemployment and employment growth rates

-

EPA Air Quality Index

-

State Departments of Veterans Affairs for education benefits and hiring policies

-

A custom scoring review of Veteran hiring preference laws in all 50 states

Scoring and Normalization

We selected 14 core variables and normalized them to a common 0-1 scale using min-max scaling. For metrics where lower values are better (such as unemployment or housing costs), we reversed the scale, so higher scores always indicated more favorable outcomes.

Each variable was assigned a weight based on its relevance to military retirees. Heavily weighted categories included housing affordability, taxation of military retirement income, and Veteran employment protections. These weights were applied after normalization to produce a composite score for each state.

Custom Metrics

We also developed a Veteran Hiring Preference Score, a custom rating based on how each state supports Veterans in public-sector hiring. This included analysis of points-based systems, interview guarantees, eligibility rules, and additional employment protections.

Ranking

After all variables were normalized and weighted, we calculated a total composite score for each state. The top 10 states had the highest combined scores across tax policy, housing costs, job access, and benefit structures.

This study reflects data available as of mid-2025. We encourage Veterans to explore each state’s Department of Veterans Affairs website and consult a financial advisor for the most current information when planning a move or retirement.